Various Economic Indicators for analyzing of National Income Statistics

We frequently encounter terms such as economic growth rate, per capita GNI, savings rate, investment rate, etc. through newspapers, TV, the internet, and other media. These are some of the economic indicators that can be obtained from national income statistics. These indicators provided by national income statistics allow us to assess not only the economic strength of a country and the standard of living of its citizens but also to grasp the overall macroeconomic situation. Here, we will introduce commonly used economic indicators:

GDP Growth Rate: The GDP growth rate indicates how fast a country’s Gross Domestic Product (GDP) is increasing. A high growth rate implies economic expansion and the creation of new jobs.

GNI per Capita: This indicator divides a country’s total Gross National Income by its population, showing how much income on average each individual has. A high GNI per capita indicates a higher average income for the citizens.

Savings Rate: This is the ratio of a country’s total savings to its Gross Domestic Product (GDP), and it is one of the indicators of a country’s economic stability. A high savings rate can have a positive impact on future investments and economic growth.

Investment Rate: This is the ratio of domestic investment to Gross Domestic Product (GDP). It is an important indicator of the potential for future economic development. A high investment rate can have a positive impact on economic growth.

Unemployment Rate: The unemployment rate represents the percentage of the labor force that is actively seeking employment. It is an important indicator of the health of the economy and the labor market.

Inflation Rate: Inflation represents the rate at which consumer prices are rising. It is an important indicator of economic stability. Appropriate inflation levels are crucial for a stable economy.

Exports and Imports: These indicators represent a country’s international trade activity. They are important for understanding a country’s economic interconnectedness and its position in the global economy.

These economic indicators are crucial for evaluating a country’s economic situation and future prospects. They provide valuable information for governments, businesses, investors, academics, and economic interest groups, and they also influence policy decisions.

Economic growth rate

When a nation’s economy grows, it can create new jobs and increase the income of its citizens, leading to improved well-being for both individuals and the country as a whole. The economic growth rate indicates how fast a nation’s economy is expanding or the overall state of economic activity. Below are some economic indicators and their values for the year 2017:

- GDP Growth Rate: 3.1%

- Manufacturing Sector Growth Rate: 4.4%

- Manufacturing Sector Contribution to Growth: 1.2 percentage points

- Per Capita Gross National Income (GNI): 3,364 thousand KRW (or $29,745 in USD)

- Per Capita Private Gross Domestic Income (PGDI): 1,874 thousand KRW (or $16,573 in USD)

- Total Savings Rate: 36.3%

- Total Investment Rate: 36.2%

- Exports as a Percentage of GNI: 84.0%

- Labor Income Distribution Rate: 63.0%

- GDP Deflator (Base Year 2010): 111.2

These figures provide an overview of the economic situation in terms of growth, income, savings, investment, trade, and more. Economic growth is typically measured as the growth rate of real GDP, which removes the impact of inflation. GDP growth is calculated annually and quarterly, and seasonally adjusted to account for seasonal variations in economic activity.

The formula for calculating annual or quarterly GDP growth rate is as follows, where t represents the year or quarter for which the growth rate is being calculated, and i represents the time period (annual or quarterly):

- For annual data (i = 1 for year-on-year growth): Growth Rate(t) = [(GDP(t) – GDP(t-1)) / GDP(t-1)] * 100

- For quarterly data (i = 1 for quarter-on-quarter growth, i = 4 for year-on-year growth): Growth Rate(t) = [(GDP(t) – GDP(t-i)) / GDP(t-i)] * 100

It’s important to consider seasonally adjusted figures when analyzing GDP growth to remove the influence of seasonal fluctuations in economic activity.

Government and economic-related institutions also calculate and report growth rates for specific economic activity sectors and expenditure categories on an annual or quarterly basis to assess performance in those areas. These growth rates help in understanding and tracking the performance of specific sectors or expenditure categories in more detail.

Growth Rates by Economic Activity Sector: Instead of using GDP, real value-added by sectors like manufacturing, services, etc., is used to calculate the growth rate for a particular economic activity sector. This helps in understanding which sector is contributing to economic growth. For example, the manufacturing sector growth rate represents the growth in the manufacturing industry.

Growth Rates by Expenditure Category: Real expenditures like private consumption, fixed investment, etc., are used to calculate growth rates for each expenditure category. This helps in tracking changes in consumption, investment, government spending, and more. For instance, the growth rate of private consumption reflects changes in individual spending patterns.

These sector-specific and expenditure category-specific growth rates provide important information for government policies and economic forecasts, as they offer insights into the performance of specific sectors or expenditure items. They are essential tools for policymakers, economic analysts, and businesses to understand and respond to economic activities effectively.

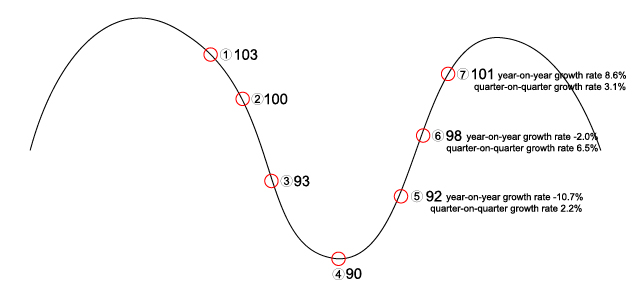

Year-on-Year Growth Rate/Quarter-on-Quarter Growth Rate

In the past, when assessing quarterly economic trends, the year-on-year growth rate of quarterly GDP (nominal) was primarily used. The year-on-year growth rate of nominal GDP, also known as “전년동기비” in Korean, was useful because it easily removed the repetitive seasonality and allowed for an estimation of changes over the course of a year. However, it had limitations as it couldn’t fully account for changes in seasonal patterns, differences in working days due to holidays, and the fact that the comparison point was one year ago, making it somewhat slow in capturing the underlying economic trends.

On the other hand, using statistical techniques to seasonally adjust quarterly GDP (seasonally adjusted series), the quarter-on-quarter growth rate, or “전기비” in Korean, became a useful tool for quickly capturing turning points in the economy. Looking at the simplified chart below (referred to as Figure 16), you can observe that the quarter-on-quarter growth rate turns positive (+) at the point where the economy starts to recover (⑤), capturing the economic upturn. In contrast, the year-on-year growth rate turns positive (+) two quarters later (⑦), indicating a delayed recognition of the economic upturn.

Contribution to growth

The contribution of economic sectors and expenditure components to economic growth can be determined through sectoral GDP contribution analysis. For example, to calculate the annual GDP contribution of the manufacturing sector, you can follow these steps:

- Collect Data: Gather the relevant data, including the GDP of the manufacturing sector for different time periods (e.g., annually).

- Calculate Sectoral Growth: Determine the annual growth rate of the manufacturing sector’s GDP. This is typically calculated as:

Sectoral Growth Rate (%) = [(GDP in Current Year – GDP in Previous Year) / GDP in Previous Year] * 100

- Calculate Contribution: To find the contribution of the manufacturing sector to overall GDP growth, multiply the sectoral growth rate by the sector’s weight in the economy. The weight is usually expressed as a percentage of total GDP. For example, if the manufacturing sector represents 20% of total GDP, and its annual growth rate is 4%, then its contribution to GDP growth would be 0.20 * 4% = 0.8%.

- Repeat for Other Sectors: Perform similar calculations for other sectors or expenditure components (e.g., services, consumption, investment) to determine their respective contributions to GDP growth.

- Sum Contributions: Sum up all the contributions from various sectors and expenditure components to get the total GDP growth rate. This represents how much each sector or component contributed to the overall economic growth for a specific period.

By calculating the contributions of different sectors and expenditure components and summing them up, you can understand the composition of GDP growth and how different parts of the economy have contributed to it. This analysis provides valuable insights for policymakers and economists in assessing economic performance and making informed decisions.

Calculating sectoral contributions to quarter-over-quarter (QoQ) and year-over-year (YoY) GDP growth rates can indeed be more complex, especially when considering expenditure components. These calculations help analyze the contributions of various factors to changes in economic performance.

To calculate contributions to QoQ and YoY GDP growth rates, you often use more advanced formulas. For expenditure components such as consumption, investment, and exports, it’s important to consider contributions to final demand (consumption + investment + exports) rather than GDP alone. This adjustment helps avoid overemphasizing the impact of imported goods on GDP growth. For example, to calculate the annual contribution to exports’ final demand, you might use a formula like the following:

Contribution to Exports’ Final Demand (%) = (Final Demand for Exports in the Current Year – Final Demand for Exports in the Previous Year) / GDP in the Previous Year * 100

In this formula:

“Final Demand for Exports” represents the total demand for exports, which includes not only the value of exports but also the demand for goods and services used in the production of those exports.

“GDP in the Previous Year” is used as the denominator to avoid overestimating the contribution due to imported goods’ impact on GDP.

This calculation method allows for a more accurate assessment of how changes in exports contribute to overall economic growth.

Similarly, you can apply similar formulas to calculate contributions to GDP growth rates for other sectors or expenditure components, both for QoQ and YoY comparisons. These contributions help provide a comprehensive picture of how different parts of the economy influence economic growth during specific periods.

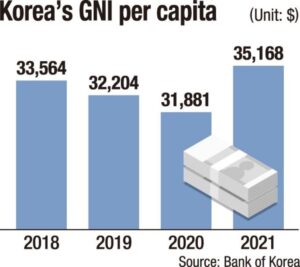

Gross National Income(GNI) per capita

“Gross National Income (GNI)” is a useful measure for understanding the overall economic size of a country. However, it may not be the most suitable indicator for assessing the average standard of living of the population. This is because the average standard of living of the people in a country is closely related to the per capita GNI.

To gauge the average standard of living, the commonly used indicator is “GNI per capita.” GNI per capita is calculated by dividing the nominal GNI by the total population of the country. It is often expressed in international comparisons by converting it into US dollars ($) using market exchange rates. This allows for a more direct comparison of living standards across different countries.

Market Exchange Rate Converted GNI per capita.

The GNI per capita converted using market exchange rates may not accurately reflect the living standards or well-being of a nation’s citizens for several reasons. Market exchange rates are significantly influenced by financial and capital transactions unrelated to the purchasing power of a currency. Additionally, they do not account for the relative prices of non-traded goods and services between countries.

For example, if citizens of a country earned 30 million won per capita for two consecutive years, but the exchange rate for the local currency (won) against the US dollar (USD) dropped from 1,500 won to 1,000 won, the GNI per capita in US dollars would appear to increase from $20,000 to $30,000. This apparent increase in income when expressed in US dollars doesn’t reflect any change in domestic purchasing power. However, when individuals from that country go abroad, they may be able to purchase more goods and services with the same income due to the favorable exchange rate, even though their real purchasing power hasn’t changed.

In summary, GNI per capita converted using market exchange rates may not accurately capture the real purchasing power or standard of living of a population, as it can be influenced by exchange rate fluctuations and doesn’t consider variations in relative prices of goods and services between countries.

GNI per capita converted using Purchasing Power Parity (PPP) exchange rates

The issues you mentioned can be addressed by converting per capita income using Purchasing Power Parity (PPP) exchange rates. PPP exchange rates evaluate the relative purchasing power of a country’s currency compared to the U.S. dollar as a benchmark. PPP exchange rates are not so much about the exchange rates between currencies but rather about indicating the real purchasing power of a country’s currency. They are used as a basis for evaluating the economic size and income levels of countries, taking into account real purchasing power.

Per capita income converted using PPP exchange rates is published and used by organizations like the United Nations, OECD, and the World Bank. According to the World Development Indicators (WDI) published by the World Bank in April 2018, South Korea’s per capita GNI in 2016, when converted using PPP exchange rates, was $36,570, which is approximately 1.3 times higher than the per capita GNI calculated using market exchange rates ($27,600). This demonstrates that South Korea’s real purchasing power, when considering relative price levels among countries, is greater than when using market exchange rates alone.

Per Capita Personal Gross Disposable Income

“1인당 GNI” is calculated in the same way as “Gross National Income per capita,” where it divides the nominal GNI of a country by its population. Meanwhile, “1인당 PGDI” is calculated by dividing the nominal PGDI of a country by its population. “Personal Gross Disposable Income (PGDI)” represents the income available to all households in a country, including non-profit organizations serving households, for consumption or savings. It serves as a somewhat limited indicator of the purchasing power of households. For international comparisons, it is sometimes converted into US dollars ($) using market exchange rates.

While “1인당 GNI” includes income distributed to households, businesses, and the government, “1인당 PGDI” focuses solely on the income distributed to households. Therefore, “1인당 PGDI” is considered to be closer to the income level that individual citizens perceive because it specifically looks at income available to households. As more income generated through economic activities is distributed to households, the gap between “1인당 GNI” and “1인당 PGDI” narrows.

For example, in 2017, South Korea’s “1인당 PGDI” was 18,740,000 won (or $16,573 in US dollars), which represented approximately 55.7% of the “1인당 GNI” of 33,640,000 won (or $29,745 in US dollars). This indicates the portion of total income available to individuals and households for their consumption or savings.

Economic Structure

The economic activities of a country can be examined by dividing them into sectors. In South Korea’s national income statistics, economic activities are categorized into sectors such as agriculture and forestry, mining and manufacturing, electricity, gas, and water supply, construction, wholesale and retail trade, accommodation and food service activities, transportation and storage, financial and insurance activities, real estate and leasing, information and communication, business services, public administration and defense, education services, health and social welfare services, and cultural and other services. For convenience, these sectors are sometimes consolidated into five categories: agriculture and forestry, mining and manufacturing, electricity, gas, and water supply, construction, and services.

The production structure refers to the proportion of value added by each economic activity sector in the total gross value added (GVA). Additionally, economic structure can be measured from an expenditure perspective, including consumption, investment, exports, and imports; this is known as expenditure structure.

In 2017, South Korea’s production structure was as follows: agriculture and forestry accounted for 2.2%, mining and manufacturing for 30.6%, electricity, gas, and water supply for 3.0%, construction for 5.9%, and services for 58.3%. The expenditure structure comprised private consumption at 48.1%, government consumption at 15.3%, total fixed capital formation at 31.1%, and net exports (exports at 43.1%, imports at 37.7%) at 5.5%.

Savings and investment rates

The income that the entire population of a country can use for consumption or savings is called Gross National Disposable Income (GNDI). It is calculated by adding net income receipts from abroad to Gross National Income (GNI). The portion of GNDI that is used for consumption and savings is divided into average consumption propensity and average savings propensity, represented as percentages, and is referred to as the consumption rate and total savings rate, respectively.

The total savings rate is further divided into various sectors, including households (including non-profit organizations serving households), businesses, and the government. The household total savings rate is calculated by dividing household total savings by GNDI. In contrast, the household net savings rate is calculated by dividing household net savings (total savings minus fixed capital consumption) by the adjusted disposable income of households (PADI) plus changes in pension fund net holdings.

These rates provide insights into the saving and consumption behavior of households, businesses, and the government within the context of a country’s overall income and expenditure patterns.

In 2017, South Korea’s total savings rate was 36.3%, with household savings rate at 7.9%, corporate savings rate at 20.0%, and government savings rate at 8.4%. Additionally, the household net savings rate was 7.6%.

Investment, which serves as a driving force for economic growth, can be divided into fixed investment (total fixed capital formation) and inventory investment (changes in inventories). Fixed investment refers to the expansion of production facilities, such as machinery and factories, by businesses to increase production. It includes not only equipment needed for production, like cars and machinery, but also residential buildings like apartments and non-residential buildings such as commercial complexes and hotels. Infrastructure facilities like roads and ports, as well as long-term assets like research and development (R&D) and intellectual property products such as computer software, are also considered part of fixed investment.

Inventory investment refers to the portion of goods produced domestically or imported from abroad that remains in storage for a certain period without being consumed, invested in fixed capital, or exported. It is not the total value of inventory in storage at a particular point in time but rather the net change in inventory that occurs over a specified period. For example, if the total inventory at the end of 2015 was 2 trillion won and it decreased to 1.5 trillion won by the end of 2016, then the inventory investment for 2016 is -500 billion won.

Funds for investment are primarily acquired through national savings. National savings can be either larger or smaller than domestic total investment. Any remaining national savings that are not used for domestic total investment are utilized for foreign investment, known as net foreign investment. When national savings exceed domestic total investment, net foreign investment is positive (+). Conversely, if national savings are insufficient to cover domestic total investment, and funds are borrowed from abroad, net foreign investment becomes negative (-). This means that national savings always match the sum of domestic and foreign investment. The percentages of domestic total investment, net foreign investment, and total savings relative to Gross National Disposable Income (GNDI) are known as domestic total investment rate, net foreign investment rate, and total savings rate, respectively. Theoretically, the total investment rate and total savings rate should always be equal.

However, in reality, there are cases where the total savings rate and total investment rate do not match due to statistical discrepancies. In 2017, South Korea’s total savings rate and total investment rate were 36.3% and 36.2%, respectively, while the domestic total investment rate and net foreign investment rate were 31.2% and 5.0%, respectively. This discrepancy is primarily due to statistical factors.

The ratio of exports and imports to GNI

Exports refer to the sale of goods produced by a country’s citizens to foreign countries, while imports involve the purchase of goods from foreign countries for purposes such as production, consumption, or investment. The percentage of exports and imports relative to Gross National Income (GNI) is known as the exports and imports-to-GNI ratio. This ratio reflects a country’s degree of economic dependence on international trade, with higher values indicating greater openness to international trade.

In 2017, South Korea’s exports and imports-to-GNI ratio was 84.0%. This ratio is calculated by dividing the total value of exports and imports, including income from abroad and payments to foreign countries, which was 1,453.5 trillion won, by the nominal GNI, which was 1,730.5 trillion won. As shown in [Figure 1-6], South Korea’s economy has a lower degree of trade dependence compared to Germany but a higher level of trade dependence compared to the United States and Japan.

labor income distribution ratio

In a country, income generated from productive activities is distributed to economic agents who provide factors of production such as labor and capital. Among these distributions, the portion that goes to households in exchange for providing labor is called “wages” or “employee compensation,” which is often referred to as “피용자보수” in Korean. The share of income allocated to the entity overseeing the productive activities is called “business profits” or “영업잉여.”

The labor income distribution ratio, or “노동소득분배율,” is calculated as a percentage by dividing employee compensation by the national income (NI), which is the sum of employee compensation and business profits.

In 2017, the labor income distribution ratio in South Korea was 63.0% which is somewhat lower compared to major advanced countries. The relatively lower labor income distribution ratio in South Korea can be attributed primarily to differences in employment structures. South Korea has a relatively higher proportion of agriculture and small-scale retail businesses compared to major countries. These sectors mostly consist of family-owned self-employment, which results in a significant portion of income being categorized as business profits.

It’s important to note that the calculation methods for the labor income distribution ratio may vary depending on the organization reporting it, so caution should be exercised when making country-to-country comparisons. The International Labour Organization (ILO) and the OECD calculate the labor income distribution ratio by dividing employee compensation by gross value added (GVA), and the United States also reports labor income distribution ratios that take into account self-employed individuals. Additionally, when calculating the labor income distribution ratio, some organizations may use the concept of “net” business profits, excluding depreciation, while others may use “gross” business profits, which include depreciation.

GDP deflator

The GDP deflator, as you mentioned, is a ratio of nominal GDP to real GDP and serves as an indicator of the overall price level in an economy. When compared to a prominent price index like the Consumer Price Index (CPI), there are several key differences:

Scope of Measurement: The Consumer Price Index primarily reflects the price level of goods and services consumed by households, focusing on the final consumer goods and services. In contrast, the GDP deflator considers a broader range of goods and services, including those used in investments, exports, and imports. It encompasses all price indicators related to the components of GDP.

Comprehensive Coverage: The GDP deflator takes into account not only consumption but also the prices of goods and services used in various sectors of the economy, such as government spending, business investments, and trade activities. It provides a more comprehensive view of overall price movements in the economy.

Production Perspective: From a production perspective, the GDP deflator is calculated based on value-added (total output minus intermediate input), which means it reflects both the prices of final goods produced domestically and the prices of intermediate goods used in production. This contrasts with the CPI, which focuses solely on the final consumption prices.

In summary, while the Consumer Price Index is a valuable measure for assessing changes in consumer prices and their impact on households, the GDP deflator is a more comprehensive indicator that considers a wider range of prices in the economy, including those related to investments, government spending, and trade, and takes a production perspective into account.

Potential Gross Domestic Product

Potential GDP (Gross Domestic Product) refers to the GDP that a country can produce when it operates at full employment levels of labor and normal levels of capital, regardless of short-term booms or recessions. In other words, Potential GDP is a long-term concept that corresponds to full-employment output or the natural level of output.

The difference between Actual GDP and Potential GDP is called the GDP gap. When Actual GDP falls short of Potential GDP, resulting in a negative GDP gap, it signifies that factors of production such as labor and capital are not being fully utilized, indicating an economic downturn. Conversely, if the GDP gap is positive, it means that factors of production are being used beyond their normal levels, indicating an economic boom. Therefore, the GDP gap is a crucial macroeconomic indicator that helps gauge inflationary pressures from the demand side.